Robert was right when he said on Tuesday that stocks had a good year.

Even despite the negative headwinds.

Don’t forget, there was plenty of bad stuff going on in the year.

The uncertainty hanging over the UK due to endless delays with Brexit for one.

The ever-present danger of deteriorating global trade was another.

And the very real threat of a slowdown and even recession in the US and other major economies also loomed large… and continues to do so.

Global stock markets saw threats… and shrugged

But despite all this, the FTSE still made 12%, on the index levels alone.

Add in dividends and it’s nearer 15%.

That’s a decent return.

And US stock markets performed even better, shrugging off all the threats.

The 30-stock Dow Jones index and the broader S&P500 went up 22% and 28.9% respectively.

And the tech-heavy Nasdaq index did even better, gaining 35.2% as investors chased growth… emboldened by the ‘Powell put’ underpinning markets.

Impressive stuff.

But not necessarily based on solid fundamentals and strong business from the underlying stocks.

Take the S&P 500 and its impressive 2019 gains.

A rally built on hope… not profits

According to analysts at Goldman Sachs, less than 10% of those gains came as a result of a growth in earnings at the companies in the index.

MarketWatch has the story:

“The stock market’s historic run in 2019 was driven almost entirely by a vigorous rise in price rather than steady earnings growth, according to researchers at Goldman Sachs.

“Valuation expansion drove nearly all of the S&P 500 return in 2019,” wrote Goldman analysts, led by David Kostin. The S&P 500 index rose nearly 29% last year, its best performance since 2013.

“Since 2009, earnings growth has been the primary driver of equities, accounting for 67% of S&P 500 returns. However, earnings growth explains just 8% of the S&P 500 return last year, Goldman’s researchers wrote.”

The price to earnings ratio or P/E is a common metric for valuing stocks and stock markets.

There are historic P/Es which use the latest full year earnings.

And there are forward P/Es which use predicted future earnings for the next year – so they measure expected earnings growth.

The P is the price and the E is earnings. So, the P/E is the price divided by earnings.

For a single stock, you take the share price and divide it by the earnings per share.

For the market, you add up all the prices of the stocks in the index and divide by the total earnings per share.

And it gives you a metric that you can use to determine whether the stock or market is fair value, undervalued or overvalued.

Typically, if a stock has a very low P/E it is ‘cheap’. And if it’s very high, it’s ‘expensive’.

Supported by the Fed

Goldmans’ number crunchers found the S&P 500’s forward P/E expanded from 14 times earnings at the start of 2019, to 19 times by the end.

And that multiple expansion accounted for a whopping “92% of the index gain”, according to Goldmans’ Daid Kostin.

So, if the profits of the companies weren’t growing, why were prices soaring?

Long-time Monkey Darts readers already know the answer, as we bang on about it enough in these pages.

It’s thanks to Jay Powell and his bunch of merry price manipulators at the Federal Reserve.

The bulk of the S&P’s multiple expansion, Kostin believes, was down to the Fed’s helping hand, cutting rates, printing money and pushing markets higher.

And clearly, investors expect more to come.

But that might not happen.

MarketWatch:

“Goldman analysts warned investors that further market-boosting measures by the central aren’t likely in 2020, after the rate-setting Federal Open Market Committee cut interest rates three times in succession last year, leaving key benchmark rates at a 1.50-1.75% range.”

If they’re right, perhaps reality will come back and knock the market back down to where it should be.

I guess we’ll have to see.

The Trump Effect

A lot depends on whether last year’s Fed policy moves have the desired effect which is to lift consumer price inflation.

Right now, inflation is low historically – below where the Fed wants it to be, which is 2%.

That’s why the Fed cut rates three times in 2019… to try to spark a rise in inflation towards the 2% target.

The current stance is that they’ve done enough.

Rates are low enough, says Powell, to encourage borrowing and promote growth and inflation… but not so low as to risk dangerously high inflation like that seen in the 70s.

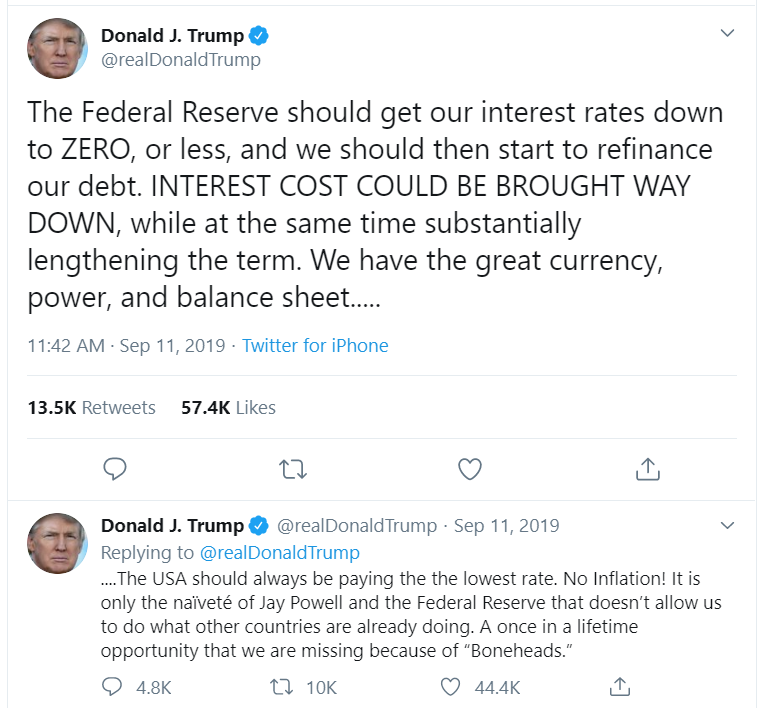

But that’s not what the guy in The White House believes.

He wants Powell to loosen the money taps some more.

He sees the negative rates in Japan and in Europe. And he wants some of that.

That, believes Trump, will put the US on an even playing field… boost economic growth, support financial markets… and get him the second presidential term he’s desperate for.

Remember his tweets back in September:

Fed Chairman Powell insists the Fed is independent.

He’s adamant that Central Bank policy won’t be influenced by greater powers.

But let’s see what happens.

Next Wednesday is important.

It’s when the Fed will tell the market its latest plans for repurchase agreement (repo) operations – in other words, asset purchases.

In addition to lowering interest rates, the Fed’s been expanding its balance sheet by buying bonds and short-term debt to keep the financial system rolling.

So, if next Wednesday’s update shows the Fed is decreasing or stopping this source of liquidity, the market could wobble.

And if that happens, expect Trump to take to twitter and lambast the Fed!

2020 could be a great year for gold

So, a good year for stocks in 2019, then. Whether that can continue through 2020 depends largely on the Fed… and on the trade war.

That’s the other big event for next week.

We’ve supposedly got the signing of the “Phase One” trade deal agreement between the US and China next Thursday.

Even if it goes through, it’s likely not the end of this.

There’s still plenty of scope for either side to renege… and even for the situation to deteriorate.

We’ve seen it happen time and again.

If things do get worse, stocks are vulnerable, especially with the indices so overvalued.

Which brings me to gold.

All the headlines are about what a good year stock markets had in 2019.

But gold had a pretty decent year, too.

From online gold platform, BullionVault:

“Gold prices ended 2019 with their 3rd highest annual finish in US Dollar terms while setting fresh New Year’s Eve records in all other major currencies except the Swiss Franc.

“Trading in London at $1523 per ounce at 10:30am on Tuesday – time of the final global benchmarking auction before 2020 – gold prices gained 18.8% from last New Year’s Eve, the 7th best annual rise of the 21st Century to date.”

Gold set new year-end records in both Sterling and Euro terms at £1,157 (up 15.2%) and €1,358 (up 21.2%) respectively.

And it’s looking good for 2020, too.

Not least from a charting perspective.

The dollar price recently broke up through the previous September highs around $1,550.

If the price consolidates there and $1,550 becomes a decent support level, there is scope for a run up to $1,800 and even all-time highs at $1,950.

Of course, recent geopolitical tension following Trump’s assassination of Iranian General Qasem Soleimani has been behind a recent spike.

The fear of all-out war in the Middle East sent capital scurrying for safety in the ultimate safe-haven asset.

That’s been averted… for now. After Iran’s carefully executed strike on a US base, avoiding casualties, Trump thankfully backed down.

And that has seen gold reverse from the spike high at $1,611 earlier in the week.

But there could still be more to come on this. Not necessarily now. But at some point.

And if there is further sabre-rattling and military strikes, gold will likely move higher.

Fear of roaring inflation

It’s not just what has been happening in the Middle east, by the way.

Long-time Monkey Darts readers know this.

There are also other factors supporting the gold price.

Chief amongst these is the central banks’ policy of lowering interest rates and pumping money in to support markets and raise inflation.

If yields are low, gold (which has no yield) becomes more attractive to investors.

And if the banks have cut rates too far – or go even further – and inflation comes roaring back, then suddenly gold will look very attractive as investors look for a store of value.

And if the price remains high, that could mean there is great value in gold mining stocks.

Particularly ones with large stockpiles of gold and which have not hedged their production. As the gold price rises, their margins get fatter.

If you though gold’s gains in 2019 were impressive, compare the performance of the metal itself to a bunch of gold mining stocks.

Avi Gilburt, writing on Seeking Alpha, explains:

“What is truly interesting to me is that many do not realize that GDX has outperformed the SPX during 2019, as it closed the year with a return of almost 40%.”

The GDX is the Van Eck Vectors Gold Miners ETF or exchange traded fund.

GDX tracks the performance of the New York Stock Exchange ARCA Gold Miners Index.

According to Investopedia, its holdings “include most major gold miners listed in the United States and Canada.”

So, big mining companies such as Goldcorp (GG), Barrick Gold (ABX), Newmont Mining (NEM), Franco-Nevada Corporation (FNV), Newcrest Mining (NCM), Silver Wheaton Corp. (SLW) and Agnico Eagle Mines Limited (AEM).

The ETF increased 40% in 2019, compared to 18.8% for the underlying gold price and 28.9% for the S&P.

That’s a decent outperformance.

And if gold’s bull market has room to run, as I believe it has, then these stocks and the ETF could do well in the year ahead.