Classic cars have delivered fantastic returns over the past 30 years, as we saw in last week’s Monkey Darts.

But I’m not suggesting we all load up on Aston Martins and Ferraris.

Let’s face it, they’re not high on most peoples’ investment portfolio wish list…

Last week I told the story of my Dad and his Aston Martin.

It was his 40th birthday present to himself.

And turned out to be one of the best investments he ever made.

In the time he owned that car, he made almost 30 times his money on it.

He bought it in 1977 for £3,000… and sold it in 2010 for £85,000.

That’s a return of 2,733%.

But it’s only half the story.

Inflation’s savage cut

Because as I said in last week’s issue, he only made that massive return in nominal terms.

The percentage increase from £3,000 to £85,000 is 2,733%.

To get the real return, we need to consider the effects of inflation.

Inflation decreases the value of money over time.

Another way to say that is that a pound loses its purchasing power when inflation is taken into account.

So, my Dad’s £1 in 1977 wouldn’t be worth anything like £1 in 2010 when he sold the car.

According to this inflation calculator, £1 in 1977 was equivalent in purchasing power to £4.85 in 2010 money.

If we follow that through to my Dad’s investment, he paid the equivalent of £14,536.81 for his car.

Which means that the real return on his investment was more like 484%, even without renovation costs.

And that’s the point of this subject I’ve been exploring lately in Monkey Darts…

Where to put your money for REAL RETURNS

I wanted to discover which have been the best performing assets over the long-term.

Most Monkey Darts readers like to do a bit of short-term trading.

Anything from a few hours to days and weeks…

A bit of forex, some index trading, maybe commodities like gold and oil.

And a lot of readers are involved with the crypto market, too, with the help of theCrypto Kickstart Programme.Short-term trading is exciting. And it can be a great way to make money once you’ve mastered it.

It’s good to have a long-term investment plan too, though. Money that you put away to grow over the years leading to retirement.

So, where’s the best place to put it?

I’ve been waiting for the latest issue of an annual report that provides some useful evidence on that.

At long last it’s out!

It measures performance of different asset classes over the 118 years since 1900.

It’s the Global Investment Returns Yearbook, published by the Swiss bank, Credit Suisse.

But the research is done by three academics from London Business School, Professors Elroy Dimson and Paul Marsh and Dr Mike Staunton.

They wrote a well-respected book a few years back called Triumph of the Optimists, studying 101 years of investment returns.

This annual report is a kind of continuation of that book.

You might suspect a report put together by three academics would be a little dry.

And you’d be right.

I tried to get hold of the full, 252-page report from the LBS press office.

But they politely refused and directed me to the 43-page summary edition.

It’s just the right amount of dry. I think 252 pages of dry would be too much.

And the summary gives the meat of it.

It’s got some interesting revelations in it, too.

Property: Not so hot

For starters, it busts the myth that property offers the best and most reliable returns of the major asset classes.

There’s no doubt that one’s house is the biggest investment most of us will ever make.

And it’s usually touted as being the number one long-term wealth generator.

But the findings of the eminent trio of academics say it’s not.

First, I don’t think this next revelation is a spoiler, because I think you already know this (I’ve mentioned it in Monkey Darts before).

It’s widely accepted…

Equities are the best performing asset class over the long term.

Every study that’s done on this kind of thing shows that to be true.

It’s down to the power of compound interest when dividends are reinvested (we touched on that last week).

So, let’s splash out the performance of some major stock markets as a starting point here.

Then we can see how poorly property compares to equities. And how well some other quirkier investments stack up.

The report looks at 23 different countries. But let’s stick with a couple of the major stock markets more relevant to our investing: UK and US.

Stocks V property

Over the 118 years, UK equities have delivered real returns of 5.5% per year and US equities have returned 6.5%.

Remember, ‘real returns’ means that they take into account the effect of inflation over the period.

And these figures include reinvested dividend income.

So, let’s see how that compares to property.

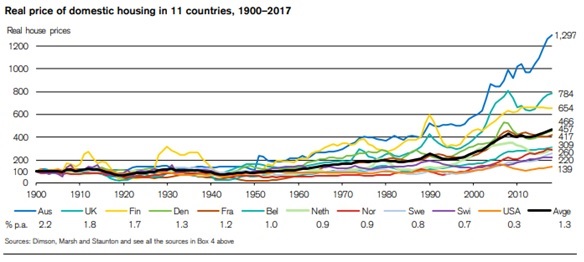

I’ve pinched a chart the authors created for their report, showing real house price returns for 11 countries…

Along the bottom of this chart you can see the annualised real return of property in these countries.

Check out how badly US house prices have done! A measly 0.3% per year.

So, on that basis, property has been thrashed by the returns made in the good old stock market. 0.3% in US property versus 6.5% in US stocks.

And it’s a similar outperformance by UK stocks (5.5% per year) over UK domestic property (1.8%).

Dig a little deeper into the report and it’s soon clear that the other major asset classes aren’t much better than property either.

Cash and bonds lag stocks

Let’s look at returns on government bonds and cash. Again, we’ll stick with UK and US data for this comparison.

In the UK, long-term government bonds gave investors real annual returns of 1.8% compared to the 5.5% on equities.

And Treasury bills, which are a kind of short-dated government-issued security (and what this report refers to as cash) were even worse.

They gave yearly returns of just 1.0%.

And it’s the same story in the US. Whereas equities returned 6.5% per year, bonds made 2.0% and bills just 0.8%.

So, it’s clear when you see all that evidence that stocks are the best long-term performing asset.

At least they have been over the past 118 years.

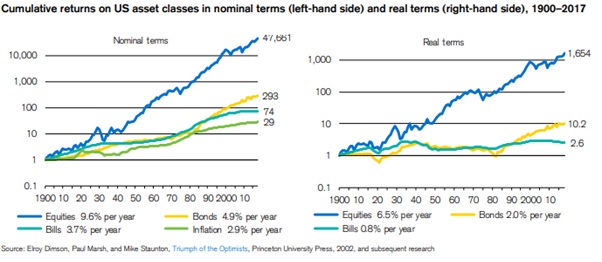

And these next charts from the Credit Suisse report show it clearly for the US market. (In my short version of the report, they didn’t have the same exercise for the UK market.)

Whereas the numbers we’ve looked at so far are annualised returns, this shows the cumulative effect of those returns.

Check out what a dollar invested in equities, bonds and bills in 1900 would be worth by the end of 2017.

On the left, it’s nominal terms and on the right, it’s real returns.

How’s that for a graphic display of the effects of inflation? It reduces the return from £1 invested in equities from £47,661 to £1,654!

Anyway, we already know stocks beat house prices.

And there’s no disputing the champ there in terms of performance between stocks, bonds and treasury bills.

Stocks take the crown.

But here’s the next big surprise from the LBS academics…

Wine beat bonds

“Collectibles such as art, wine and musical instruments have beaten cash and government bonds.”

You read that right.

Over the past 118 years, you’d have done better putting your money in wine or violins than in government bonds.

Whether you’re ever likely to put your money into a Stradivarius violin or case of vintage Bordeaux, I don’t know. (I like to think I might do if I had a large enough pot.)

John Authers in the FT picks up the story about “collectibles” here:

“Wine, at 3.7 per cent per year in real terms, came closest to stocks, while stamps and violins (only Guarneri and Stradivarius were included) also beat bonds.

“Art at 1.9 per cent lagged behind bonds, but did at least come out ahead of gold, which had a real return of only 0.7 per cent per year.”

This is an interesting point for me.

I’ve always been a fan of gold. I guess it’s the company of stock market bears and gold bugs I’ve kept over the years.

So, I was surprised to see it get the thumbs down by the authors of the Credit Suisse report. The FT’s John Authers again:

“Gold proved to provide a hedge against extreme inflation and deflation, but to perform poorly at other times. Gold, like silver and diamonds, has underperformed bonds and even cash since 1900, according to their figures. Gold has also inflicted a more volatile ride.

“Gold was not alone in this, with wine, platinum, violins, silver all having a higher standard deviation of returns over time than world equities. Automobiles could be a partial exception. They have a shorter history than the other popular collectibles but lag only stocks.”

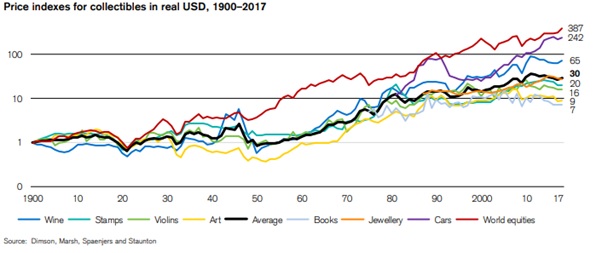

To get a feel for how some of these collectible markets have performed, here’s another chart…

As the report summarises it:

“Since 1900, the average collectible (thick black line in chart) rose 30-fold in terms of purchasing power – equivalent to an annualized price appreciation of 2.9% – but returned less than stocks globally.”

We’re getting the picture, aren’t we?

Stocks rule

The academics offer conclusive proof: stocks win.

There’s nothing out there that comes close to the performance of the equity market over the long term.

At least not when you look at the past data.

We don’t know that it will continue that way. But the chances are good that it will.

But there are three points the authors make in their summary that are worth us bearing in mind…

“Looking ahead, expected returns on all asset classes are likely to be low as the authors’ research shows that when real interest rates are low, as they are today, subsequent returns tend to be lower.”

“The authors predict that the margin by which equities are likely to outperform cash in future will be lower than the 118-year historical premium of 4.3% per year. Their long run forecast is 3½%.”

“Even with a lower future equity premium of 3½%, equities are still expected to double relative to cash over a 20-year period.”

None of which alters the case for stocks being the best-performing asset class over the long term.

That’s not so say that we shouldn’t consider putting some of our long-term money into other asset classes.

Spreading your eggs among several baskets makes a lot of sense. Especially when different assets behave differently in different market environments.

I mean I take on board what these guys say about gold being a bit rubbish over the long-term.

But it’s not going to change my mind that it makes sense to hold some gold and silver.

They are assets that should perform well if the main financial markets (stocks, bonds) collapse… or if inflation gets out of control.

A new contender

And then there is the unknown quantity: crypto currencies.

None of these ultra long-term studies can include bitcoin, Ethereum or any other crypto because they haven’t been around long enough.

But there’s huge potential for the blockchain (the technology that cryptos are based on) to change the way many of the industries we know today will operate in the future.

That means there’s a very real chance for significant returns from some of these cryptos. (They’ve already made 1,000s of per cent gains in some cases!)

And not just short-term returns – perhaps there will be huge long-term wealth builders among them. Perhaps they’ll feature in one of these studies in years to come.

Have you dipped your toe in the crypto market yet? It’s exciting stuff that’s for sure. And the opportunity for profit is real.

But don’t go in blind.

Get some help from people who know this market.

Someone who will warn you about the pitfalls. And tell you about the best opportunities to get into.

The good news is, we have a guy right here at Canonbury who does exactly that for a group of our readers.

Click here to meet our number one crypto expert.

I’ll be back next Friday – have a great weekend.